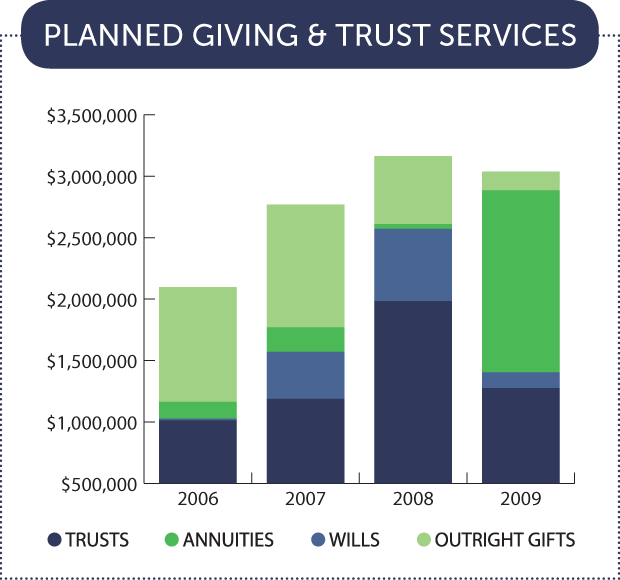

It was 2007. Church borrowing from the Revolving Fund had risen from 12 million in 2005 to 23 million and the project requests kept coming. The conferences in our union had approved $6,000,000 more of borrowing from the fund and the churches were all needing funds at once for their church purchases and building projects.

We struggled to figure our cash flows in order to meet their needs. We analyzed all our investments to determine what we could convert to cash. First we sold all the most liquid investments in the Revolving Fund taking $175,000 of gains on the redemptions. Then we traded for the more liquid investments in the operating fund. We sent out thousands, tens of thousands, and hundreds of thousands of dollars until the churches approved for borrowing had completed their projects. Each outlay was an act of trust in God to continue to work things out, but some days (and nights) we worried that we wouldn’t have the funds available as they were needed.

Then came the financial market crash of 2008. Because of the run of projects in 2007 our Revolving Fund assets were almost all at work building and purchasing churches rather than in the financial markets. We watched the financial markets tumble while we recounted God’s guidance. We were assured that God had been watching over His funds and had put them to work where He wanted them at just the right time—before the crash.

[…] reCOUNTing God’s Blessings – Elaine Hagele […]